san mateo county tax collector property tax

The County Managers Office provides instructions and forms for the Assessment Appeals process. Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records.

The fee is imposed by the credit card companies and cannot legally be absorbed by the County therefore the fee must be passed on to the customer.

. Each of them are responsible to the public for the assessment collection and. The median property tax in San Mateo County California is 4424 per year for a home worth the median value of 784800. You also may pay your taxes online by ECheck or Credit Card.

What period of time does an unsecured tax bill cover. Sandie Arnott San Mateo County Tax Collector. County of San Mateos Treasurer-Tax Collector offers a Secured Property Tax Search where you can find your property tax by searching by address or parcel number.

The property tax extension occurs after the roll has been turned over by the Assessor to the Controller and after the County Board of Supervisors has adopted the tax rates for the current year. For specific information please call us at 866 220-0308 or visit our office. San Mateo County has one of the highest median property taxes in the United States and is ranked 45th of the 3143 counties in order of median property taxes.

What are unsecured property taxes. Once the Assessor or the Assessment Appeals Board makes the decision to reduce the assessed value. In San Mateo County the heads of these offices are elected officials.

The Assessors Office website provides an explanation of the Assessment Appeals process external link. See Property Records Deeds Owner Info Much More. The Treasurer-Tax Collector does NOT retain any portion of this fee.

Doxo is the simple protected way to pay your bills with a single account and accomplish your financial goals. For more information call 6503634501. All credit card payments are processed through our payment service.

For specific information please call us at 866 220-0308 or visit our office. With approximately 237000 assessments each year the Assessor Division creates the official record of taxable property local assessment roll shares it with the County Controller and Tax Collector and makes it publicly available. The Assessor is responsible for determining the assessed value of all taxable property located in San Mateo County.

However you have until 500 pm. Ad Get In-Depth Property Reports Info You May Not Find On Other Sites. However they are still required to file a statement if requested by the Assessor.

Make Tax Checks Payable to. Redwood City CA 94063. Get In-Depth Property Reports Info You May Not Find On Other Sites.

Property tax refunds generally result from reassessment of your property. Phone Hours are 9 AM - 5 PM Monday - Friday Excluding all Holidays. At least before.

San Mateo County TreasurerTax Collector Sandie Arnott an elected official is charged with managing and protecting the Countys financial assets. These tax rates are also applied to the valuation assessed by the State on utility property. Announcements footer toggle 2019 2022 Grant Street Group.

The funds are invested in a portfolio of credit instruments called a pool. She acts as the banker for the County and directs the investment of the Countys funds. Small business owners may be exempt from personal property tax assessment in San Mateo County if their personal property is valued at 5000 or less.

Property Tax Bills and Refunds San Mateo County Assessor-County Clerk-Recorder Elections - ACRE. The following are questions we often receive from San Mateo County unsecured property owners. Search Any Address 2.

The amount of taxes due for the current year can be found on the TreasurerTax Collectors web site or contact the Tax Collectors Office at 8662200308. Office of the Assessor. The State Controllers Property Tax Postponement Program allows homeowners who are seniors are blind or have a disability to defer current-year property taxes on their principal residence if they meet certain criteria including 40 percent equity in the home and an annual household income of 35500 or less.

The 1st installment is due and payable on November 1. When is the unsecured tax assessed. Of December 10th to make your payment before a 10 penalty is added to your.

Please be aware that there is a 235 service fee for payments. The property tax process in San Mateo County like most other California Counties is split between three different offices - the Assessor the Controller and the Tax CollectorTreasurer. 555 County Center - 1st Floor.

2 reviews of Tax Collector County of San Mateo The representatives are very courteous and knowledgeable to help surprisingly. The following are questions we often receive from San Mateo County property owners. How are the unsecured tax amounts determined.

Scott Randolph was elected Orange County Tax Collector in November 2012 and reelected in 2016. In fulfilling these services the Division assures that the County complies with necessary legal. 9 AM - 5 PM.

San Mateo County secured property tax bill is payable in two installments. Online Secured Tax Payments. San Mateo County collects on average 056 of a propertys assessed fair market value as property tax.

2019 2022 Grant Street Group. The Property Tax Division manages key aspects of the property tax process including that property taxes payable by each taxpayer are accurately calculated taxes collected are accurately distributed to taxing agencies and that any tax refunds due are processed in a timely manner.

Using The Tax Payment System Tax Collector

Complete Guide To Property Taxes In San Diego

Coyote Point Beach San Mateo Ca I Grew Up Here I Walked Here From Our Home In Burlingame Over The Bridge San Mateo County San Mateo Beach

1165 San Mateo Dr Salinas Ca 93901 Realtor Com

615 Port Dr Apt 207 San Mateo Ca 94404 Realtor Com

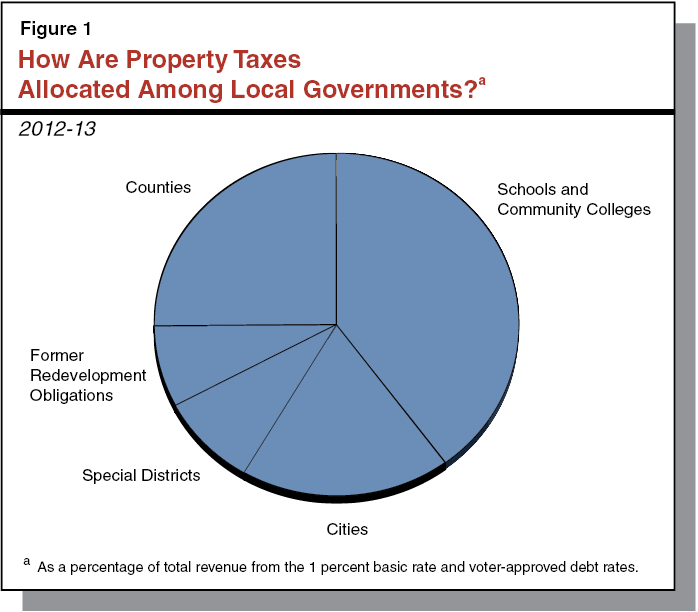

The 2014 15 Budget Pilot Program To Improve Property Tax Administration

1594 Brandywine Rd San Mateo Ca 94402 Realtor Com

Using The Tax Payment System Tax Collector

Using The Tax Payment System Tax Collector

545 S San Mateo St Redlands Ca 92373 Realtor Com

San Gregorio Creek Watershed County Of San Mateo Ca

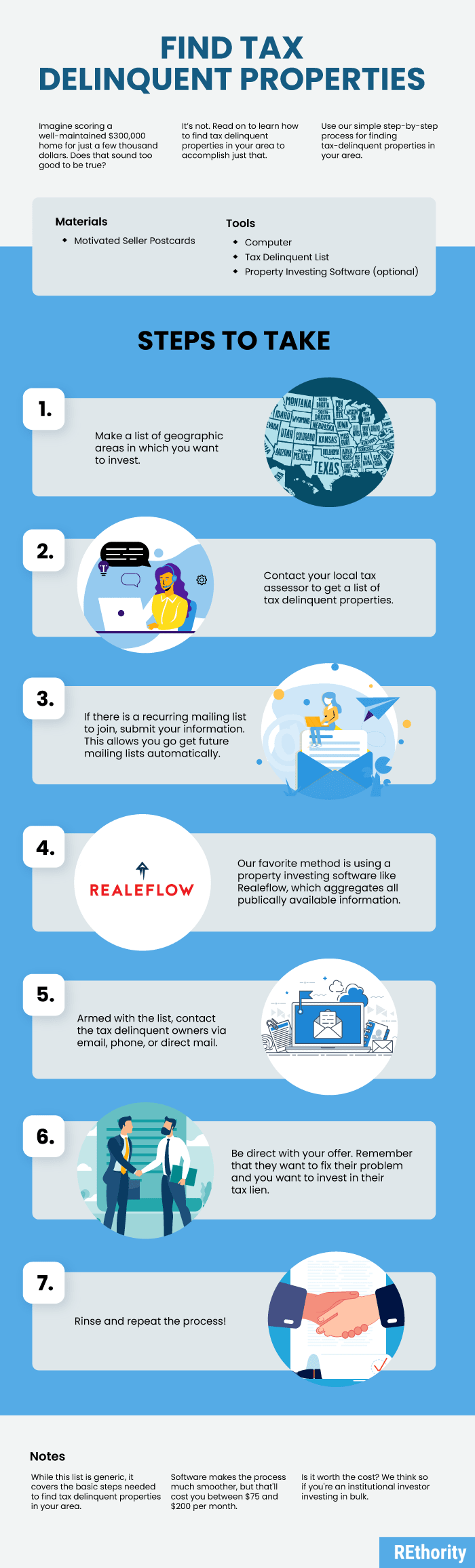

How To Find Tax Delinquent Properties In Your Area Rethority